Lost or Stolen Car Keys Replacement Insurance Coverage – All You Need To Know. How To Get Reimbursement, How Much Money They Cover & More.

Table of Contents

Introduction:

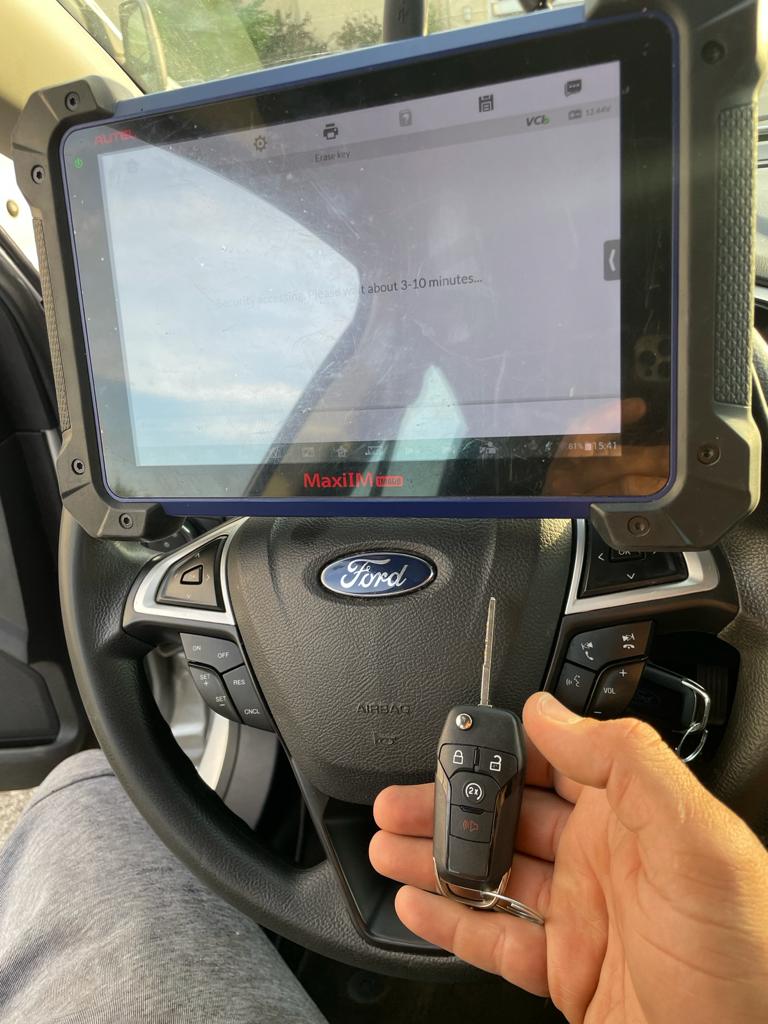

Replacing lost or stolen car keys involve time and money. In addition, especially for newer models that operate with a push-to-start technology, the process may cost even more. Click here for more information about the estimated costs and tips on saving time and money when replacing your car keys.

Many times, even though we are not aware of that, our insurance policy may cover the cost or at least a portion of getting a new replacement car key.

That is, of course, depends on the type of key you had and your insurance coverage.

Common types of coverage

We did research to find out which insurance companies cover replacement keys or stolen items as well as if car keys are covered under warranty.

While most companies will offer lockout, towing, fuel delivery, tire changes, and jump-start coverage, replacement car keys are not covered. They do, however, offer at least a partial reimbursement for lost or stolen car keys, usually between $100-$200 of the total cost.

In addition, we found that AAA also covers between $50-$150 with certain memberships.

Therefore, we would highly recommend calling your insurance agent before deciding how to replace your car keys.

The reason is that some insurance companies work with a specific locksmith provider in your area and if you choose to do it on your own, it may result in failure to get reimbursement for your expense.

Tips to help you get reimbursed:

Regardless if your insurance policy cover replacement car keys or not, it may cover lockout services under emergency roadside assistance coverage, which is most times up to $100.

Now, since most of the time losing your car keys means you are also locked out of the car, there you go, you can get a reimbursement! Just don’t forget to ask the locksmith to mention the lockout charge as part of the service.

Finally, and we can’t emphasize how important this is: always, but always, get an invoice for the money you spent and submit it to your insurance company, even if you didn’t call them before. Many insurance companies will reimburse you nonetheless!

Not ready to call for service just yet? Get great ideas how to find lost car keys here.

What should I do to make sure I get reimbursed and avoid delays from my insurance in case I lost my car keys?

First, once you realize you lost your keys, call them. Explain the situation and ask if you are covered for this type of incident. In addition, don’t forget to ask if you have lockout coverage, which may be relevant for you as well to reduce the total cost.

Then, ask what your options are. Some insurance companies will tell you to contact a local locksmith and submit the invoice.

Others will contact a locksmith on your behalf.

Regardless of what they tell you, make sure to keep the invoice.

In addition, it would be better to pay with a CC to show additional proof.

Moreover, in cases where the keys were stolen, contact the police and report it. Keep it for your record, as the insurance company may want that.

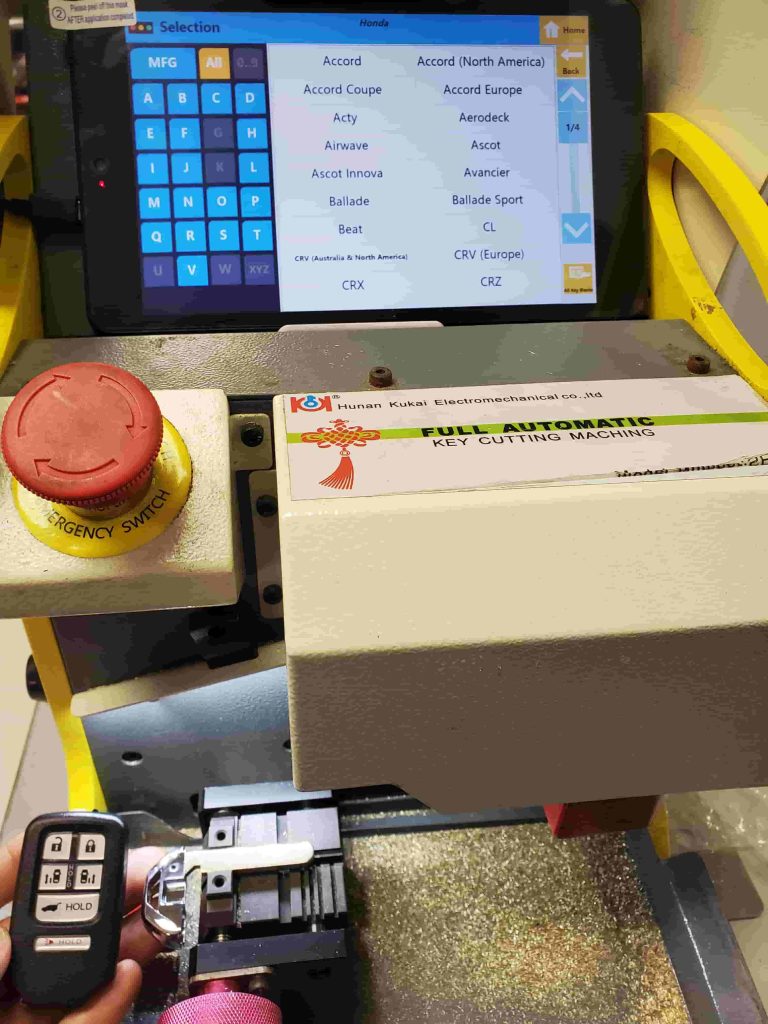

In addition, in case you contact a locksmith, make sure he or she gives you an invoice with a detailed description of the work:

The type of key they sold you, VIN number, year make, and model clearly stated on the invoice, as well as your name and service address.

Finally, to avoid a situation where your premium goes up, make sure you verify this before you submit the claim.

In conclusion, it is always a good idea to call your insurance agent if you lose your car keys. It may save you a lot of time and money!

Check your insurance coverage options:

AAA – https://autoclubsouth.aaa.com/automotive/roadside-assistance.aspx

Allstate – https://www.allstate.com/auto-insurance/towing-labor-coverage.aspx

American Family Insurance – https://www.amfam.com/insurance/car/emergency-roadside-service

Amica – https://www.amica.com/en/claim-center/roadside-assistance.html

Auto Owners – https://www.auto-owners.com/claims/road-trouble-service

Erie Insurance – https://www.erieinsurance.com/auto-insurance/emergency-road-service

Esurance – https://www.esurance.com/info/car/emergency-road-service-coverage

Farmers – https://www.farmers.com/claims/roadside-assistance/

Geico – https://www.geico.com/auto-insurance/emergency-road-service/

Hartford – https://www.thehartford.com/car-insurance/comprehensive-car-insurance

Liberty Mutual – https://www.libertymutual.com/auto/car-insurance-coverage/comprehensive-insurance

Nationwide – https://www.nationwide.com/roadside-assistance.jsp

Progressive – https://www.progressive.com/claims/roadside-assistance/

State Auto – https://www.stateauto.com/insurance/individuals/roadside-assistance/

State Farm – https://www.statefarm.com/claims/get-roadside-assistance

The Hartford – https://www.thehartford.com/car-insurance/towing-insurance

Travelers – https://www.travelers.com/car-insurance/coverage/roadside-assistance

USAA – https://www.usaa.com/inet/ent_search/CpPrvtSearch?SearchPhrase=roadside%20assistance